![7 Business Risk Response Strategies [+Mitigation Plan]](https://www.alertmedia.com/wp-content/uploads/2024/12/Blog-2024-RiskResponseStrategies-V2-1024x536.jpg)

7 Business Risk Response Strategies [+Mitigation Plan]

Avoidance isn’t always possible when faced with a threat; it’s only one of seven common risk response strategies to address uncertainty and protect your business.

Risk is an inherent part of business. Acceptance of that is essential to achieving growth-driving gains. Many executives recognize this reality; 83% reported actively focusing their strategies on growth, even amid challenges like cyber threats, economic downturns, and talent shortages. Rather than being held back by these risks, leaders view them as opportunities to build resilience and position their organizations for long-term success. These seven business risk response strategies can help you turn threats into opportunities for growth.

Download Our Risk Mitigation Plan Template

Risk Avoidance vs Risk Acceptance

When is a risk necessary? Many business decisions hinge on this question. The choice to avoid a risk can be just as potentially detrimental as taking a risk. A famous real-life example comes from Kodak, once a giant in the photography industry and the inventor of the digital camera. In the 1970s, Kodak recognized it as a potential threat to its core business of selling film.

So, they chose avoidance as their risk management strategy, doubling down on their legacy products and relying on internal studies that claimed the technology would be slow to catch on. After all, who would want a photo stored on a computer?

It turns out, a lot of people did. The digital camera they invented—and the threat they tried to sidestep—ultimately led to their bankruptcy. By avoiding the short-term risk of disrupting their business model, Kodak failed to adapt to the industry revolution they created.

This is a prime example of why you must carefully consider avoiding or accepting risk. While avoidance may feel safe at the moment, it can lead to missed opportunities or even greater dangers down the line. The key is to identify when a risk is worth taking and approach it with a sound strategy.

1. Adopt an Avoidance Strategy

In the Kodak example, risk shouldn’t have been avoided—but that’s not always the case. Sometimes, the avoid option is the only viable choice when the threat to the enterprise is too significant. You need to meet some risks with a zero-tolerance approach due to the catastrophic consequences they could pose.

Specifically, you should adopt a risk response strategy focused on quitting the risk entirely when:

- The threat is catastrophic (e.g., it could lead to bankruptcy or permanent closure).

- The business operates in a highly regulated industry with exponential and difficult-to-calculate risks.

- The potential benefits of taking the risk do not outweigh the possible losses.

A classic example of when a risk avoidance strategy is critical involves sanctions. The U.S. enforces sanctions against various entities for reasons such as human rights violations and criminal or terrorist activities. However, our complex global financial system often muddies the water. A business could unintentionally contribute to a sanctioned entity if it isn’t vigilant about detailed tracking of its financial activities.

Failing to address this threat to the enterprise can lead to devastating outcomes. Companies could face massive fines and penalties, lawsuits for contributing to illegal activities, restrictions from operating in certain markets, and severe reputational damage. Adopting a zero-tolerance stance in these situations protects businesses from irreversible harm.

By leveraging the avoidance option when appropriate, businesses can shield themselves from catastrophic risks while focusing resources on sustainable growth opportunities.

2. Accept the Risk and Strategize

If avoiding the risk isn’t an option, decision-makers must accept a certain degree of uncertainty or potential loss in exchange for anticipated benefits. Acceptance aligns with a company’s risk appetite (the overall level of risk the company is willing to take) and risk tolerance (the acceptable limit for a specific category within this broader appetite).

Situations where acceptance is common include:

- When avoiding the risk is impossible or is inherent to the nature of the business (e.g., weather delays affecting supply chains, market fluctuations in finance, and bloodborne pathogen exposure in healthcare).

- When efforts to avoid the risk are not cost-effective, it could hinder business growth or damage competitive standing (e.g., ignoring major industry disruptors in favor of legacy products or abandoning valuable trade routes to avoid minor regulatory challenges).

- When the risk can be managed through a reduce (mitigate) strategy or preparation.

In these situations, scenario analysis or sophisticated modeling can help decision-makers evaluate potential outcomes and refine their approach. For example, industries like air travel accept the risks associated with delays, operational disruptions, and fluctuating costs. By engaging in root cause analysis and risk monitoring, they identify critical areas of exposure and implement strategies to minimize the negative impact.

All the following are risk acceptance strategies in some way. What changes are the specific steps you need to take to maintain resilience against a threat.

3. Reduce or Minimize the Threat When You Can

A risk reduction strategy accepts the presence of the threat but works to reduce its severity or likelihood. Risk tolerance levels are quantified to create a benchmark to compare against potential risk events and guide decision-making. This approach ensures that risks remain within acceptable limits while achieving organizational objectives.

A risk mitigation strategy is appropriate when:

- Redundancies in place to help maintain operations despite disruptions (e.g., backup systems or contingency plans).

- The organization has a clear game plan for impact reduction (e.g., disaster recovery strategies and crisis management).

- The risk is not expected to cause prolonged harm or exceed the organization’s tolerance level.

As an example of risk mitigation, a financial firm may use advanced software to monitor stock price fluctuations and reduce exposure to market volatility. The software tracks predefined thresholds, automatically selling assets if prices drop below a certain point, thereby minimizing potential losses. This proactive approach helps the company stay within its risk tolerance while preserving financial stability.

4. Embrace a Strategic Risk-Taking Mindset

Sometimes, business leaders must embrace uncertainty to achieve strategic aspirations. Unlike avoidance or risk mitigation strategies, this approach focuses on the potential for high rewards. Organizations adopting this strategy often rely on a mix of qualitative (e.g., expert judgment, risk management plans) and quantitative tools (e.g., statistical modeling, cost-benefit analysis) to weigh the potential benefits against the risks. This way, they can balance ambition with uncertainty management.

A risk-taking strategy is appropriate when:

- The potential benefits include a significant competitive advantage or market leadership.

- The risks align with the organization’s strategic aspirations and are within acceptable risk tolerance levels.

- Risk professionals have conducted thorough evaluations, identifying manageable pathways to address key uncertainties.

- The risk is time-sensitive, and inaction could result in lost opportunities or stagnation.

This is probably one of the hardest strategies to trust because there is no guarantee. Most companies will face a make-it-or-break-it moment where they must decide whether to take a bold risk or play it safe. For Amazon, that moment came when it decided to launch Amazon Web Services in 2006.

At the time, entering the cloud computing market represented a significant departure from its core business. The concept of cloud computing was still in its infancy; the potential market was uncertain. Amazon assessed its risk appetite and determined that the potential benefits of pioneering this technology outweighed the harmful risks.

To manage the uncertainty, Amazon evaluated the opportunity using a mix of qualitative tools (like internal pilots) and quantitative tools (such as financial modeling). This decision aligned with its strategic aspirations of innovation and market leadership. By taking this calculated risk, Amazon accepted short-term challenges to pursue long-term rewards.

The result? AWS became a game-changer, giving Amazon a massive competitive advantage and transforming it into a global leader in cloud services.

5. Plan for the Worst With a Contingency Strategy

A contingency strategy prepares for a risk in the event it materializes. This approach is particularly useful for risks that cannot be entirely mitigated. Instead of trying to prevent the risk, the organization develops plans to respond effectively if it occurs.

A contingency strategy is the right choice when:

- The risk is outside the organization’s control (e.g., economic upheaval or civil unrest).

- The risk has a history of occurring or a high likelihood of recurrence (e.g., data breaches or IT asset retirement).

- The potential impact of the risk could disrupt critical operations without preparation.

This type of strategy is common in the cybersecurity environment. For example, a company might have a backup server system in place to ensure data availability in case its primary storage is compromised—whether by a data breach, extreme weather event, or hardware failure. Preparing for these potential risk events helps organizations reduce downtime and maintain operations.

6. Transfer the Risk to Another Party

Just about every company assigns some of its organizational and/or project risks to another, whether through insurance, vendor services, or legal guidance. This describes the risk transfer strategy, which is appropriate when:

- The financial impact of a potential adverse event is too high for the organization to bear without jeopardizing operations.

- The risk involves intangible losses, such as reputational damage, where specialized external support is critical.

- The risk can be effectively transferred through contractual arrangements, such as indemnification clauses or outsourcing agreements.

Risk transfer happens commonly when a company outsources a process to reduce liability or operational complexity. For example, many companies outsource their payroll. Given the high number of regulations and requirements involved, the organization can shift the responsibility to a company specializing in these risks while reducing its own.

7. Escalating the Risk up the Chain of Command

While a transfer strategy involves moving a risk outside your organization, an escalation strategy pushes it up the internal chain of command. This approach ensures that appropriate stakeholders—with the necessary authority and expertise—address the risks.

An escalation strategy is appropriate when:

- The risk is outside the expertise of team members. For example, if a new regulation is issued in a foreign country, it may require legal or compliance specialists to interpret and implement necessary changes.

- The risk could impact teams across departments. Something may start as a project management issue, like an imperfection in a design, but escalate across departments when that design has already entered into production.

- The risk presents an ongoing threat to operations and has not been addressed in an appropriate timeframe. Something may be on the risk register but inappropriately marked as low priority.

Escalation strategies are prevalent in industries where risks can start small but rapidly grow in complexity. For example, a minor equipment malfunction detected on the production floor might initially seem like a routine issue in the manufacturing industry. However, if left unresolved, it could lead to widespread production delays or safety hazards. The problem would be escalated to operations managers or engineers with the expertise to diagnose and fix the root cause.

Similarly, in the healthcare sector, a localized outbreak of a mild infection might be flagged by a nurse. If the potential for rapid transmission is identified, the risk would be escalated to hospital administrators or infection control specialists to implement containment protocols. This strategy ensures that what starts as a manageable issue does not become a crisis affecting patient safety and care quality.

How to Consistently Apply the Right Risk Response Strategy

Consistently applying the right risk response strategy requires three steps: identify, categorize, and map the risk. These three steps act as an enterprise risk management framework for various threats.

Risk identification

Risks can arise at any level, from individual to project management, process issues, or organizational concerns. Threats to your business can also create a domino effect, triggering new risks that didn’t exist before. That’s why risk identification is the first and most critical part of any risk assessment plan. You must be fully aware of all the threats your business faces, both obvious and hidden, to prepare for negative impacts.

There are several ways to identify risks:

- Historical records: Analyze past incidents, patterns, and metrics to anticipate recurring threats.

- Threat intelligence platforms: Advanced tools and platforms can provide real-time monitoring and alerts tailored to your industry, helping you stay ahead of emerging risks.

- Risk assessments: This methodology includes systematic evaluations of vulnerabilities and potential exposures to help you adapt to new threats.

- Stakeholder feedback: Gather input from team members, customers, and partners to uncover risks that may not be immediately visible.

- SWOT analysis: Regularly evaluate your strengths, weaknesses, opportunities, and threats to identify internal and external risks.

- Data analytics tools: Use advanced software to spot trends, anomalies, or potential issues within your operations.

- Scenario planning: Run hypothetical scenarios to test how your business would respond using your risk response plan for various risk events.

Combining these methodologies can lay the groundwork for effective risk response strategies. This comprehensive picture will help you categorize the risk as one you will either avoid or accept as part of your risk management process.

Risk categorization

At this stage, the primary focus is whether the risk should be avoided entirely or accepted and managed. To reiterate, you should prioritize avoidance when:

- The risk is avoidable without negatively impacting the business’s operations or objectives.

- The risk is catastrophic, such as a scenario that could lead to bankruptcy or permanent closure.

- The risk is tied to strict regulations, such as sanctions or legal requirements, where any misstep could result in severe penalties or reputational damage.

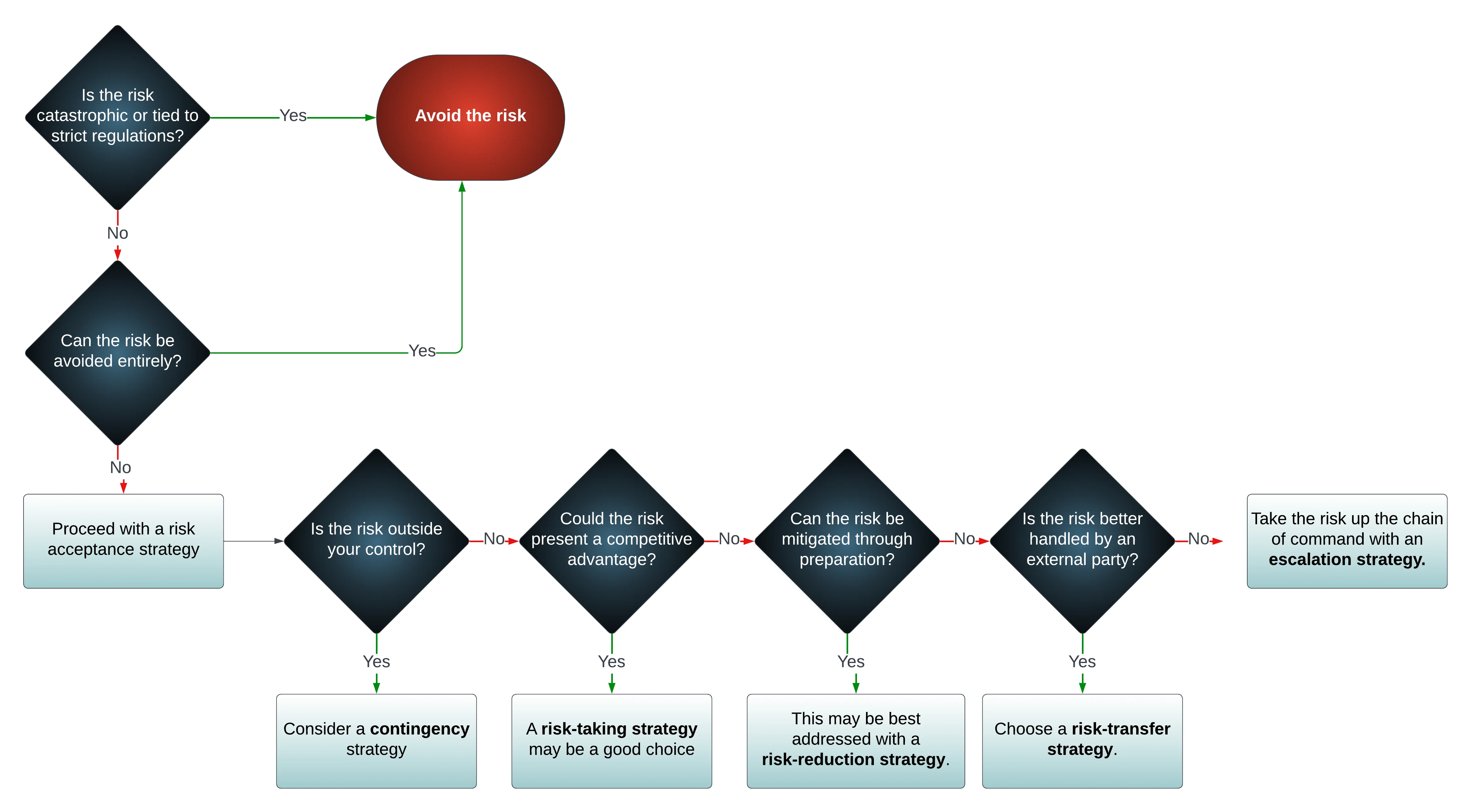

If the risk does not meet these criteria, it typically falls into the acceptance category. To manage it effectively, you can apply strategies such as risk mitigation, transfer, or escalation. We can map the risk with a flowchart or other visual aid to decide on those.

Risk mapping

Mapping involves evaluating the threat to determine the most appropriate risk response. By asking a series of close-ended questions, you can create a structured pathway that guides you to the right approach. Below is a risk strategy flowchart that illustrates how this process might unfold.

Suppose, in the mapping stage, you’ve determined that you will accept the organizational or project risk. Now, your goal is to narrow down which acceptance strategy—or combination of strategies—is the best fit. This involves asking detailed, specific questions:

1. Can you control the risk?

If a risk outside your control is highly likely to occur, you’ll need a contingency strategy. For example, if you’re likely to face extreme weather, a contingency plan may include moving your workforce remotely or implementing a facility response plan.

2. Could positive risks provide a competitive advantage?

If the way you do business is evolving, a positive risk-taking approach may be appropriate. For example, venturing into an emerging market could require careful risk analysis and strategies that balance ambition with preparedness to support project success.

3. Can you prepare for the impact of the negative risk?

If the answer is yes, a risk reduction strategy could be ideal. Combining this with contingency measures—such as a health and safety or natural disaster response plan—can further safeguard your operations from uncertain events.

4. Do you have the internal expertise to handle the type of risk?

If not, a risk transfer strategy might be necessary. Outsourcing specific risks and responsibilities, like cybersecurity or utilities management, helps with the allocation of team members’ time and resources while allowing experts to handle the threat.

5. Is escalation necessary if you can’t offset, reduce, or capitalize on potential risks?

When risks require involvement from higher levels of authority, an escalation strategy ensures the issue reaches organizations or project team members who can allocate resources or implement decisions effectively.

Resilience Strategies

Risk response strategies help keep your business resilient while enabling you to pursue calculated growth opportunities. Success begins with clearly identified risks, accurate categorization, and careful mapping, all aligned with your business goals and supported by informed decision-making tools.

Adapting your approach based on your organization’s specific needs is key. To make this process easier, download our risk mitigation plan template.

![How To Make Risk Mitigation Work [+Template]](https://www.alertmedia.com/wp-content/uploads/2023/01/Risk-Mitigation-Steps-Blog-V1.jpg)